Navigating the nuanced world of classic car investments may seem like an undiscovered road for many. However, the allure of these timeless motoring jewels cannot be ignored: their enduring beauty, pivotal roles in automotive history, and the pure, unparalleled satisfaction they offer to discerning aficionados. Classic cars have evolved beyond sentimental collectables, becoming genuine investment contenders, much like fine art or high-end real estate. This navigational guide will discuss the irresistible allure of classic cars as a lucrative investment, the most sought-after models with appreciating market values, effective acquisition strategies, and the crucial elements of sustaining the value of a classic car investment.

Understanding the allure of classic cars

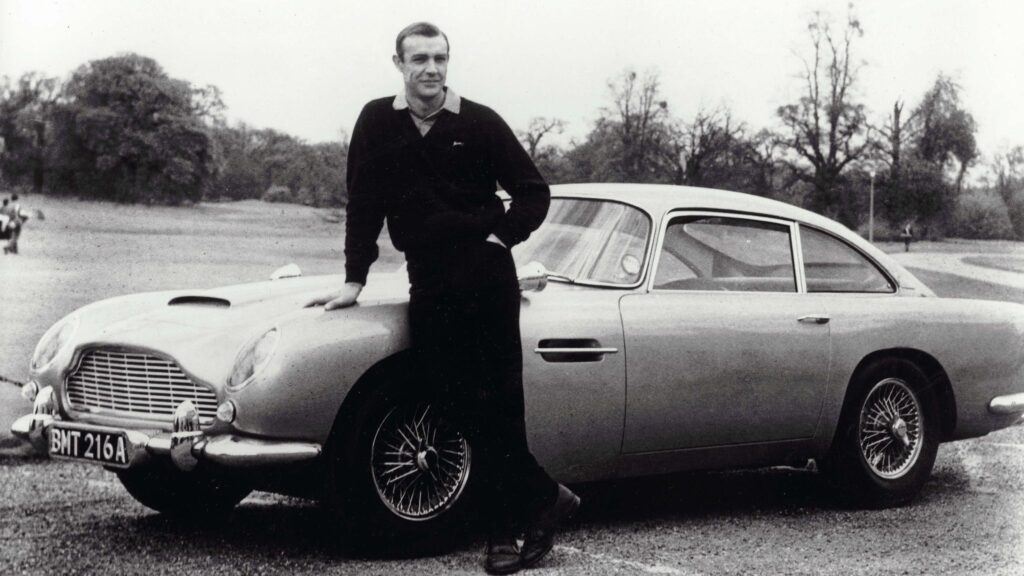

(Photo Credits: SkyNews; HypeBeast)

Consider this. The mellifluous burble of a historic V8 engine, the tangible weight of antiquated switchgear; there’s an intimate relationship, a whisper-thin link to the past, that only a classic car can offer. The joy of reveling in a vintage car goes far beyond vehicular aesthetics; it’s an unparalleled voyage into history, societal change, technology, and yes, luxury, that oozes an intoxicating blend of nostalgia and exclusivity. Still need convincing? Perhaps the illustrious examples of Hollywood star Steve McQueen’s 1968 Ford Mustang GT or James Bond’s shiny Aston Martin DB5 might help corroborate the allure.

Classic cars aren’t just dainty objects of longing; they’ve cemented their status as rock-solid investments consistently outperforming conventional assets. An asset that not only earns a return but commands prestige and flaunts style? Now we’re talking.

While every Tom, Dick, and Harry with a Wall Street job can buy shares, it requires an exquisite taste for rarity, a discerning eye for unique beauty associated often with celebrity owners, special editions, and limited production lines, to curatorially invest in the classic car market. So why, despite their high upfront costs, do these timeless beauties continue to attract seasoned and next-gen investors alike?

The value of classic cars appreciates impressively and consistently over time. According to the Knight Frank Luxury Investment Index, they were the top-performing luxury asset in 2017, witnessing an awe-inspiring appreciation of a whopping 332% over a decade!

(Photo Credit: Gooding & Company)

Next comes the exclusivity. What was once a luxury playground for the likes of McQueen and Bond has become an accessible avenue for individuals seeking unique investments. The thrill of driving a Bentley S2 or a Lamborghini Miura, once the choice of the rich and the famous, is now achievable for those savvy investors willing to venture off the beaten track of traditional investments. Plus, there’s the thrill of ‘the find’, that unspeakable joy of discovering a rare model lost in the sands of time.

Part investment, part prized possession, classic cars offer the exceptional opportunity to marry passion with profit. As the world shifts towards a more environmentally conscious stance, with automakers moving aggressively towards electric vehicles, the value, exclusivity, and allure of gas-powered classic cars is only set to soar.

(Photo Credit: GAA Classic Cars; GearMoose)

Dive into the exotic world of classic cars, relish the prestige, enjoy the perks, and witness your investment flourish. After all, if money can’t buy happiness, it sure can buy a piece of automotive history that can offer an exhilarating ride toward a profitable future. But remember, before embarking on this high-octane investment journey, always consult a trusted expert or classic car guidebook. There’s a mint condition ’63 Corvette Stingray or a sublime Jaguar E-Type out there waiting for you; rev up and seize the road less traveled.

Top Classic Cars to Consider for Investments

Isn’t it rather magical how certain milestones in history remain timeless? Fine wines may age, and precious metals may fade, but classic cars, a motley fleet of historical artifacts, continue to break free from the rust of time. While being passionately preserved, restored, and paraded akin to symbols of patrician grandeur, these magnificent machines have also become the latest road to wealth, thanks to their staggering investment returns.

(Photo Credit: Motorious; Imgur)

An auto-portrait of Steve McQueen’s 1963 Ferrari 250 GT Berlinetta or Marilyn Monroe’s icy Raven Black 1956 Thunderbird could give any art oeuvre a run for its money. The ownership histories of these classic chariots not only add a cinematic color to their profiles but also have the power to drive their market values through the roof.

(Photo Credit: Getty Images)

Though much is always said about the breakthrough IPOs conquering the stock market or the opulent villas shadowing pristine coastlines, the remarkable performance of classic cars on the investment front often goes unnoticed. Yet, they remain steadfast, constantly outpacing traditional investment assets. Consider if you will, the 1957 Ferrari 335 S Spider Scaglietti that fetched a colossal $35.7 million at an auction, or the 1962 Ferrari 250 GTO which raced past with a record-setting bid of $48.4 million. These iconic vehicles don’t merely justify their price tags with their rarity, but also with extraordinary returns on investment.

In no terms does the investment potential of classic cars reside exclusively in the regal garages of the super-rich. The democratizing wave of classic car investments has allowed for individuals in different wealth spectrums to join the classic car club. While it does hold an elite dominion, its compulsion towards inclusivity has seen a diversity in participating investors, adding an extra gleam to these vintage vehicles.

(Photo Credit: Mecum Auctions; Forza Forums)

It is in the discerning chase of these elusive gems, attractions such as a factory original 1970 Dodge Challenger R/T or a 1948 Tucker Torpedo, that the adrenaline of the classic car investment culture draws its fuel from. These elusive beauties, each with a story of its own, provide a thrilling terrain for treasure hunters to venture into.

Elite investors who have dared to traverse the graceful curves of the investment landscape, wedding their fervor for the antiquated with a discerning eye for returns, have been handsomely rewarded. Rekindling the charming courtship between the love for the road and love for their bank account, investors are riding off into the sunset, pockets heavy with lucrative profits.

Yet, as the world tiptoes towards an environment-oriented consciousness, will the rhythmic purr of a gas-guzzling classic give way to the hum of an electric dynamo? For now, the charm in the nostalgia and the exhaust note of an old-fashioned internal combustion engine hold both the admirers and investors captivated.

Remember, gearheads and potential investors, take a pause at this crossroad and consult the auto-Bibles of Hagerty or the Classic Car Club of America. An informed spin around the classic car circuit is what separates an unfortunate breakdown from a joyride to the bank. Strip away the veneer of hasty enthusiasm and ensure you’re taking the most promising route, because, when it comes to classic car investments, it’s not merely about the journey, but also the destination – a sumptuous pot of gold amidst the glamour and grease!

The Art of Acquiring Classic Cars

Think of a classic car as a blank canvas of opportunity, just waiting for a craftsman’s touch. The most successful car collectors – from Microsoft’s Paul Allen to comedian Jay Leno – understand that each vehicle represents a stunning fusion of art and engineering. And what better way to let that artistic instinct roam free than to partake in the high-stakes yet rewarding world of classic car investments?

Take for instance the 1962 Ferrari 250 GTO, one of only 39 ever built. Not only does it scream ’60s racing pedigree from every panel, but it also carried an impressive value proposition when it sold at auction for a record-breaking $48 million in 2018. Attracting heavyweight investors and captivating onlookers, this model is a classic example of the remarkable appreciation seen in the classic car market.

Successfully navigating this market, however, requires more than just an affluent wallet. Leveraging knowledge and understanding the subtleties can mean the difference between a good investment and a great one. Esteemed figures such as Ralph Lauren and Pink Floyd’s Nick Mason did not amass their remarkable car collections overnight. They leveraged their groundwork, putting in hours of meticulous research, understanding each car’s provenance, and assessing restoration needs to gain an edge.

(Photo Credit: Uncrate)

Indeed, it’s important to remember that an investment-grade car isn’t just about age or rarity, it’s also about condition and historical significance. For example, the 1994 McLaren F1 ‘LM-Specification,’ despite being far younger than its Antique peers, fetched $19.8 million due to its immaculate condition and being one of only two converted to Le Mans specifications.

While elusive vehicles like the Bugatti Type 57SC Atlantic or the Shelby Cobra remain at the higher end of the price spectrum, market democratization has brought investment-grade staples like the Porsche 911 or Chevrolet Camaro within reach to a wider audience. These machines may lack the glitz of their illustrious brethren but often offer a rewarding entry point for novice investors into the fascinating world of classic cars.

As the wane of the petrol era begins to dawn, the allure of the classic gas-guzzling icons only seems to be amplifying. Even amidst growing environmental concerns, the unmistakable roar of a Ferrari 250 Testa Rossa or the sleek form of a Lamborghini Miura continues to captivate and charm investors and enthusiasts alike, carving their irreplaceable place in automotive history.

(Photo Credit: Scott Grundfor)

In this enthralling journey, whether it’s the thrill of the hunt for that elusive Jaguar E-Type or the satisfaction of seeing a meticulously restored Mercedes-Benz 300SL Gullwing increase in value, it’s always the joy of ownership intermingled with proud profits that makes investing in classic cars an experience like no other.

Therefore, aspiring investors; let passion be the compass, but let knowledge be the roadmap. Our love for these vehicular masterpieces transcends timelines, but it is our informed decisions that rein in remarkable returns. After all, isn’t it every car enthusiast’s dream to share garage space with history while watching their investment portfolio accelerate?

Sustaining Your Classic Car Investment

Classic cars are the last word in luxury because, as you well know, they represent a world of nostalgia, craftsmanship, and unparalleled pedigree. Yet, these cherished relics are not simply aesthetically pleasing or emotionally satisfying acquisitions; they are dynamic assets that can continuously inspire, influence, and enhance your overall investment portfolio, provided they’re adeptly cared for and preserved.

As with any wise choice, from selecting a select reserve Scotch whiskey to securing a spot on the Canne’s red carpet, the key to preserving, and furthermore elevating, the value of classic cars lies in the refining, nurturing, and fascinating realm of maintenance and meticulous upkeep.

Think of your classic car as a Rembrandt or Monet masterpiece. While the unique strength and authenticity of its inner workings are unquestionably part of what adds value and draw to it, keeping it visually stunning and operational comprise the other side of this elegant equation.

(Photo Credit: Men’s Health)

First and foremost, proper storage is crucial. Ideally, classic cars should be parked in a clean, dry, climate-controlled garage, much like one would store a swanky Louis Roederer Cristal Brut vintage to keep it away from damaging light and fluctuating temperatures.

All ye knights of the luxury roadways, do also pay heed to one rule above all else: keep thy esteemed novelty running. Yes, that means turning the ignition key regularly, even if the calendar doesn’t hold a countryside drive or classic car rally in view. An idle classic car is to high-end luxury what a stagnant portfolio is to an entrepreneurial tycoon: an evitable disaster. Bringing the engine to life ensures all mechanical components and liquids stay in optimal condition, thus prolonging the car’s life and maintaining its value.

Waging the perpetual war against rust and deterioration also comes with the territory. Here, a regular detailing schedule using top-of-the-range products can add points to your preservation score. Remember not to skimp on the quality of the detailing products used, as classic cars deserve all the premium pampering they can get, much like a Guild of 18 gold timepiece deserves expert horological care.

When it comes to driving investments, it’s wise to recall the golden mantra – originality always wins. Hence, maintaining, restoring, or potentially replacing original car parts with genuine ones helps to preserve, if not raise, the vehicle’s resale value. Enlist the expertise of seasoned mechanics proficient in the specific make and model of your automobile. Contemporary technology meets timeless majesty here, and the result is a well-preserved, high-performing classic car that ticks all the right boxes in the investor’s checklist.

It goes without saying, that meticulous documentation – from maintenance records, and restoration receipts, to historical documents – will play your favored ally when it comes to appreciating the value of your vintage beauties. Rainbow-colored stones from the House of Graff aren’t sold just on their brilliance but on their GIA certification.

It’s a riveting expedition, this journey of classic car investment. Among the elite echelons of memento bottles of Macallan or the rare bubble of a Patek Philippe Calatrava, your classic car holds its own. And by giving it the care, reverence, and attention it commands, you’re ensuring that this sophisticated symbol of yesteryears continues to be a delightfully gratifying facet of your investment landscape for years to come.

The allure of classic car investment lies not just in their physical essence but extends into their compelling backstories, the thrill in procuring them, and the profound satisfaction of preserving their splendor. Investment in these motoring works of art demands commitment and passion but rewards those who espouse these qualities with significant returns. The journey, from understanding the appeal of classic vehicles to maintaining their prime condition, is a captivating expedition filled with rich discoveries and potentially rewarding investments. Exploring such a unique domain is as exciting as charting an untraveled terrain. Classic cars hold a mirror to history while promising a lucrative future for the astute visionary willing to undertake this nostalgic path.